Jorge Paulo Lemann, along with his partners Alexandre Behring, Carlos Sicupira, and Marcel Telles, have found success in various industries such as banking, Brazilian beer, and burgers. Their latest venture involves a $7.1 billion deal to acquire a controlling stake in Dutch window blinds and coverings maker Hunter Douglas. This investment is expected to yield significant returns, with 3G having already turned down offers for a minority stake at a valuation that would result in a substantial profit.

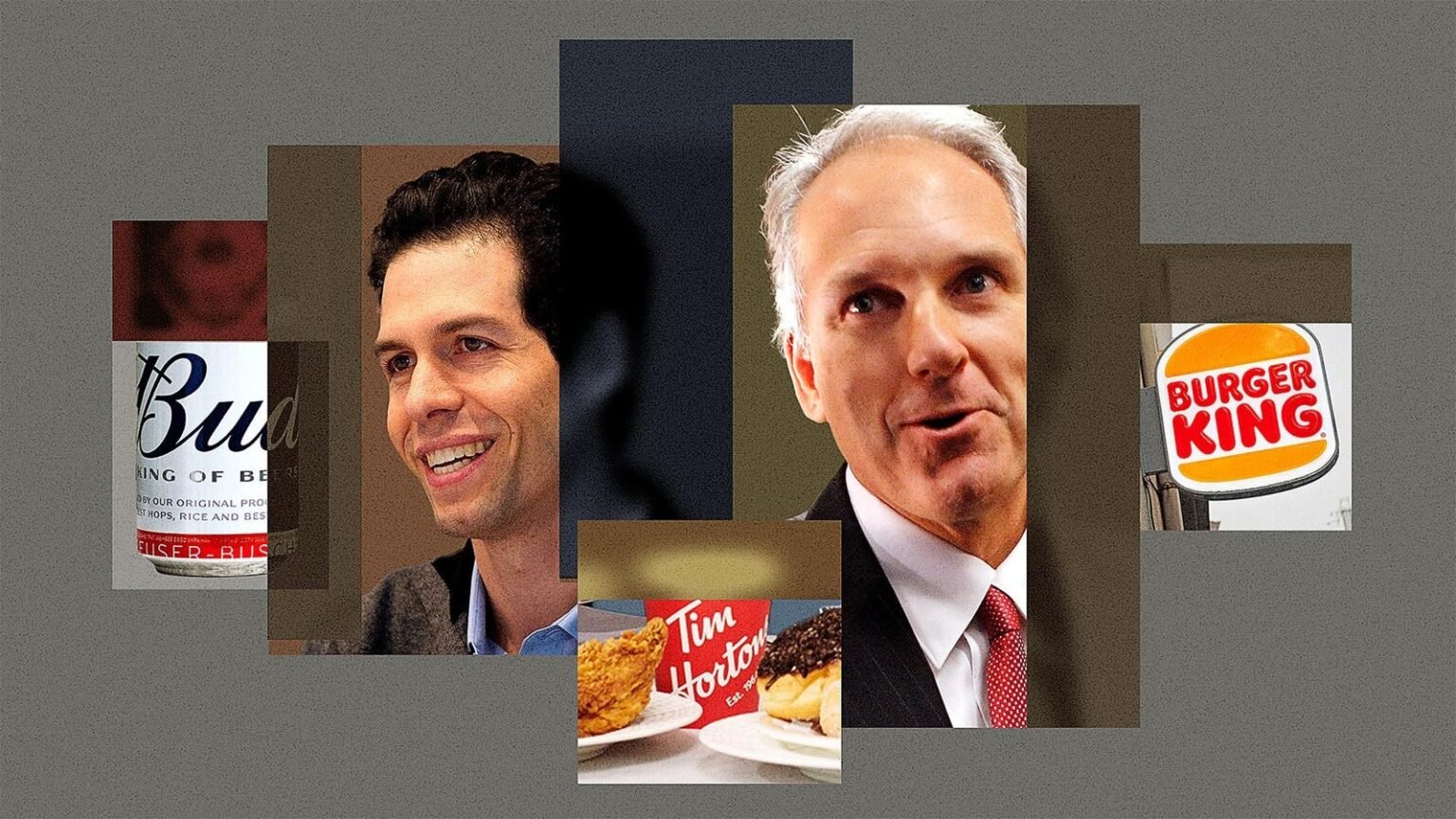

3G Capital, with $14 billion in assets under management, has a unique investment approach that focuses on a small number of investments over a long period. Their first major success was the acquisition of Burger King, which has resulted in a 28-fold return and $20 billion in gains for the firm. Despite some less successful investments, such as the merger of Heinz and Kraft, 3G’s track record remains strong, with a current stake in Restaurant Brands International worth about $9 billion.

The founding partners of 3G, including Lemann and Behring, have a combined wealth of $43 billion. The firm was established in 2004 with the goal of expanding beyond Brazil, with early investments in the beer industry leading to the formation of AB InBev, the largest brewer in the world. The success of these initial ventures laid the foundation for future investments, including the turnaround of Burger King and subsequent acquisitions of Tim Hortons, Popeyes, and Firehouse Subs.

While 3G’s focus has predominantly been on food and beverage companies, the acquisition of Hunter Douglas represents a new direction for the firm. By applying their expertise in operational efficiency and global expansion, 3G aims to capitalize on the potential of the window coverings market. The company’s CEO, João Castro Neves, has been tasked with leading this initiative and driving growth in new markets.

Despite the success of their previous investments, 3G remains patient in its search for the next big opportunity. The firm’s leaders emphasize their commitment to finding great businesses, building strong ownership teams, and driving organic growth through operational improvements. With a long-term perspective and a track record of success, 3G Capital continues to look for ways to generate significant returns for its partners and investors.

As 3G Capital continues to expand its investment portfolio, the firm’s leaders remain focused on their core principles of efficiency, growth, and value creation. With a strategic approach to identifying and developing opportunities, 3G is poised to capitalize on emerging trends and industries while maintaining a long-term perspective on investment success. Behring’s spearfishing philosophy of remaining calm and decisive translates into their approach to investing, ensuring that they make strategic decisions that lead to profitability and sustained growth in their ventures.