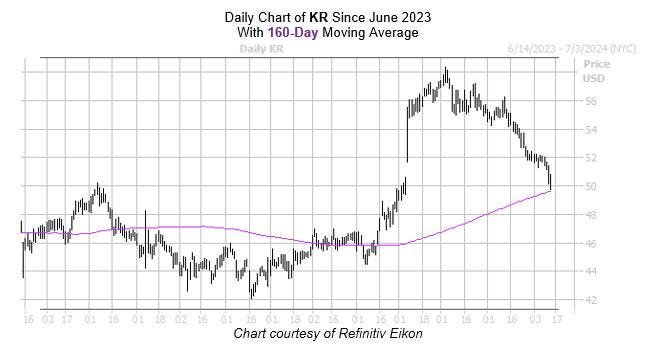

Kroger is set to release its first-quarter earnings report on June 20, with a history of mostly positive post-earnings reactions in the past two years. The stock has shown an average post-earnings swing of 4.2%, with the options market now pricing in a higher move of 6.3%. This could potentially help Kroger stock, which has seen a 12.8% slide this quarter and is now only 5.5% higher than a year ago, currently trading at $49.82.

Despite the recent decline in Kroger stock, it remains up 9% since the beginning of the year. However, the options market has shown bearish sentiment over the past 10 weeks, with a 50-day put/call volume ratio of 1.26 ranking higher than 78% of readings from the past year. Additionally, the majority of analysts covering the stock are also hesitant, with nine out of 17 recommending a hold or worse rating.

Investors will be closely watching Kroger’s earnings report to see if it can reverse its recent downward trend and potentially see another positive post-earnings reaction. The stock has shown resilience in the past, with several next-day sessions posting gains, including a 9.9% jump in March. With the options market pricing in a higher move this time around, there may be the potential for a positive surprise that could boost investor confidence in Kroger.

It will be important to pay attention to Kroger’s performance in key areas such as revenue and profit growth, as well as any guidance provided for the rest of the year. Any positive developments could help support the stock and potentially drive it back towards its year-to-date high. On the other hand, disappointing results could further drag down Kroger’s performance and lead to continued bearish sentiment in the options market and among analysts.

Overall, Kroger’s upcoming earnings report will be a key event for investors to watch, as it could provide insight into the future direction of the stock. With a history of positive post-earnings reactions and the options market pricing in a higher move this time around, there is anticipation for a potential turnaround in Kroger’s performance. Investors will be looking for signs of strength in key areas to support the stock’s future growth and potentially regain its upward momentum.