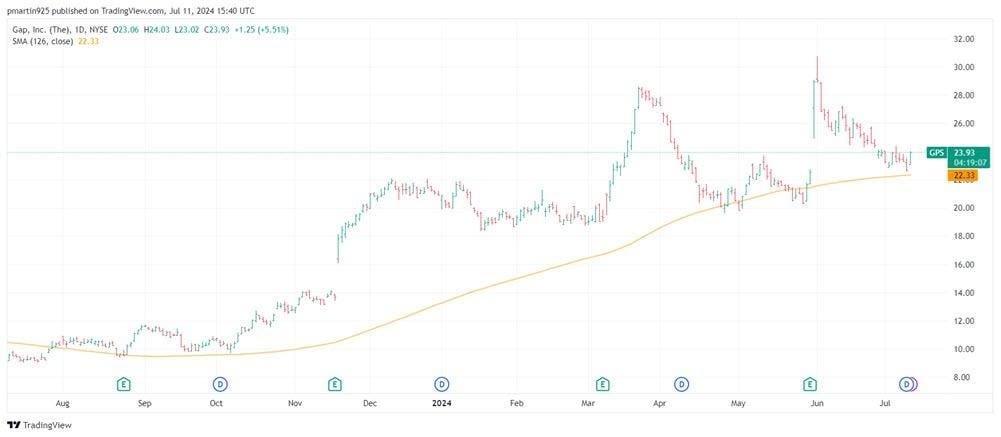

As Gap stock continues to show potential for a breakout, investors are closely monitoring the trendline that the stock has been testing in recent weeks. The stock has seen a significant pullback in June, dropping 17.5% after hitting three-year highs earlier in the summer. However, the stock is now within one standard deviation of its 126-day moving average, which historically has been a bullish indicator. Schaeffer’s Senior Quantitative Analyst Rocky White notes that Gap has seen positive returns after hitting this trendline in the past, with an average return of 9.2%.

One of the reasons Gap has caught the attention of investors is its contrarian potential. Despite a healthy year-to-date gain of 14.4%, half of the analysts covering the stock rate it as a “hold” or worse. Short sellers have also increased their positions in the stock, with 15.8% of GPS’ total available float sold short. This high level of short interest could potentially lead to a short squeeze if the stock continues to move higher, as short sellers may need to buy back shares to cover their bets.

In the options market, Gap has seen a high level of call buying relative to put buying, with a 10-day call/put volume ratio of 11.49. This suggests that some investors may be using calls to hedge against any unexpected upside in the stock. Despite the potential for a breakout, options premium has not yet seen a spike in volatility ahead of Gap’s quarterly earnings report on Aug. 22. The stock’s Schaeffer’s Volatility Index (SVI) is currently at 45%, which is in the 10th percentile of its annual range, indicating that options traders are not expecting a significant move in the stock in the near future.

Overall, Gap stock continues to show promise for a potential breakout, with the stock testing a historically bullish trendline on the charts. Despite a recent pullback, the stock has the potential to rebound and fill its 30-day deficit of 10.7%. With a high level of short interest and contrarian potential, Gap is a stock that investors will be watching closely in the coming weeks leading up to its quarterly earnings report.