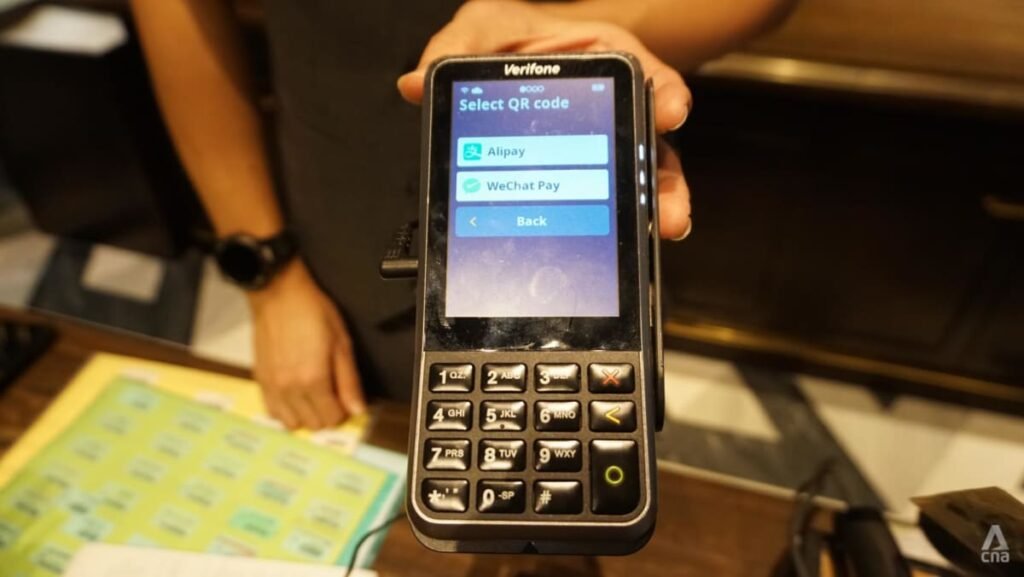

In recent months, there has been a notable increase in the acceptance of Chinese e-payment methods in Singapore. One example of this trend is a hotel that started accepting cashless payments on WeChat Pay and Alipay for various services including dining, spa services, and suite stays. Although official figures were not disclosed, the hotel confirmed an increase in the number of guests using these digital payment methods. Similarly, local bike-sharing operator Anywheel saw significant growth in users from China after launching a mini program, with three times more users registering with Chinese phone numbers within six months.

Not only major establishments, but also smaller businesses like hawkers in Singapore have embraced Chinese e-payment methods. According to official statistics from the Singapore Tourism Board (STB), approximately 10,000 hawkers were accepting payments through WeChat. Ms. Rachel Chua, who runs a drink stall in Maxwell Food Centre, shared that Chinese tourists often use Alipay for even small purchases like 30-cent tissue packets. To cater to this demographic, she prominently displays WeChat Pay and Alipay signs at her stall. However, there are still some Chinese tourists who prefer to use cash and coins for smaller transactions, as not all establishments accept digital payments.

Despite the growing acceptance of Chinese e-payment methods in Singapore, there are still instances where tourists, like Ms. Li Xiang from Guangxi, opt to use cash and coins. During her visit to Singapore with her boyfriend, Ms. Li exchanged cash just in case some smaller places like hawker stalls did not accept WeChat or Alipay. While shopping malls are more likely to accept digital payments, smaller establishments may still rely on traditional forms of currency. This highlights the transition period as businesses adapt to the increasing demand for digital payment options.

The shift towards digital payments is not only beneficial for businesses in Singapore but also for Chinese tourists who find it more convenient and hassle-free. With the popularity of WeChat Pay and Alipay in China, tourists can now seamlessly make purchases in Singapore without the need to carry physical money. This not only streamlines the payment process but also caters to the preferences of tech-savvy travelers who are accustomed to using digital wallets in their daily lives.

As more businesses in Singapore adopt Chinese e-payment methods, there is a growing opportunity for collaboration and partnership between Singaporean and Chinese companies. This trend not only enhances the overall customer experience for Chinese tourists but also opens up new avenues for businesses to tap into the lucrative Chinese market. By leveraging digital payment solutions, establishments in Singapore can position themselves as more accessible and accommodating to Chinese visitors, thereby increasing their competitiveness in the tourism industry.

In conclusion, the rise of Chinese e-payment methods in Singapore reflects a larger trend of digitalization in the global economy. With the increasing demand for cashless transactions, businesses are adapting to meet the preferences of tech-savvy consumers, including Chinese tourists. As more establishments in Singapore accept WeChat Pay and Alipay, there is a growing shift towards a more seamless and efficient payment ecosystem that benefits both businesses and consumers. This trend not only enhances the overall visitor experience in Singapore but also promotes cross-border collaboration and innovation in the realm of digital payments.