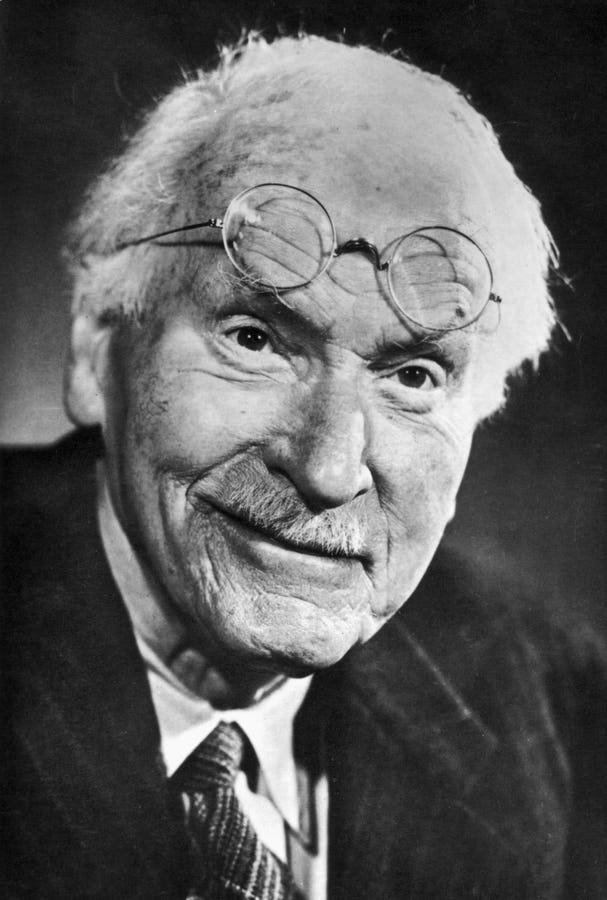

Financial planning is heavily impacted by the pain of loss, which has been found to be twice as powerful as the joy of gain. With this in mind, recovering from financial mistakes can be a daunting task. However, the key to getting back on track is simple: do the next right thing. This advice, popularized by the recovery movement, can be traced back to a letter written by renowned psychiatrist Carl Jung in 1933. Jung’s message to a struggling individual emphasized the importance of forging one’s own path and taking action, rather than waiting for a clear-cut solution or direction.

In the realm of financial planning, there is no one-size-fits-all approach. It is not about following a predetermined path set by banks, financial advisors, or experts like Dave Ramsey or Suze Orman. Instead, the goal of financial planning is to identify what is truly important to you in life and then aligning your financial resources to achieve those goals. While the process may seem overwhelming, Jung’s advice to simply take the next necessary step can serve as a guiding principle in decision-making.

The BAT Success Triangle, which emphasizes Behavior, Attitude, and Technique, underscores the importance of taking action in achieving success. While individuals may spend time searching for the perfect technique or waiting for the right attitude to align, the simple act of moving forward can often yield meaningful results. Jung’s message reminds individuals that the path to success is not always clear, but by taking decisive action, one can make progress towards their goals.

By focusing on doing what you know is right rather than waiting for perfect solutions, individuals can avoid common financial pitfalls and make progress towards their objectives. Whether it’s starting a new diet, exercise routine, or financial plan, taking the first step can lead to a sense of accomplishment and direction. While the complexities of wealth management may seem daunting, the key lies in the simple act of moving forward and doing what needs to be done.

Ultimately, the process of financial planning is about discovering what is important to you and taking tangible steps to achieve those goals. While the journey may involve multiple steps and decisions, the initial focus should always be on doing the next right thing. By following this principle and taking decisive action, individuals can navigate financial challenges, recover from mistakes, and move towards a more secure financial future. As Carl Jung’s advice reminds us, the key to success lies in taking that first step and trusting that the next necessary action will become clear as we move forward.