A flare-up in exchange rate markets in Argentina has caused panic following the approval of the Ley de Bases and fiscal package by Congress. Economy Minister Luis ‘Toto’ Caputo and Central Bank associate Santiago Bausili’s response to the situation exacerbated the run on the peso, leading to emergency measures to try to calm the tensions. The government’s communication strategy, led by advisor Santiago Caputo, seemed to falter in this crisis, reminiscent of past government missteps.

Despite progress in reducing inflation and stabilizing the peso-dollar exchange rate, doubts have arisen about the sustainability of the government’s economic policies. The approval of Javier Milei’s reform package was expected to boost confidence in the economy, but instead, the peso weakened, impacting purchasing power. Questions about Caputo’s credibility and the sustainability of the current policy framework have emerged, particularly regarding the lifting of currency controls and exchange rate policy.

The International Monetary Fund and local economists have criticized the government’s economic model, urging for a devaluation and removal of distortive taxes to allow for a lifting of currency controls. The agro-export sector has adopted a wait-and-see strategy, waiting for promises made by the Milei administration to be fulfilled. Milei and Caputo’s resistance to negotiation may be challenged by the IMF, leading to questions about their ability to navigate Argentina’s economic challenges.

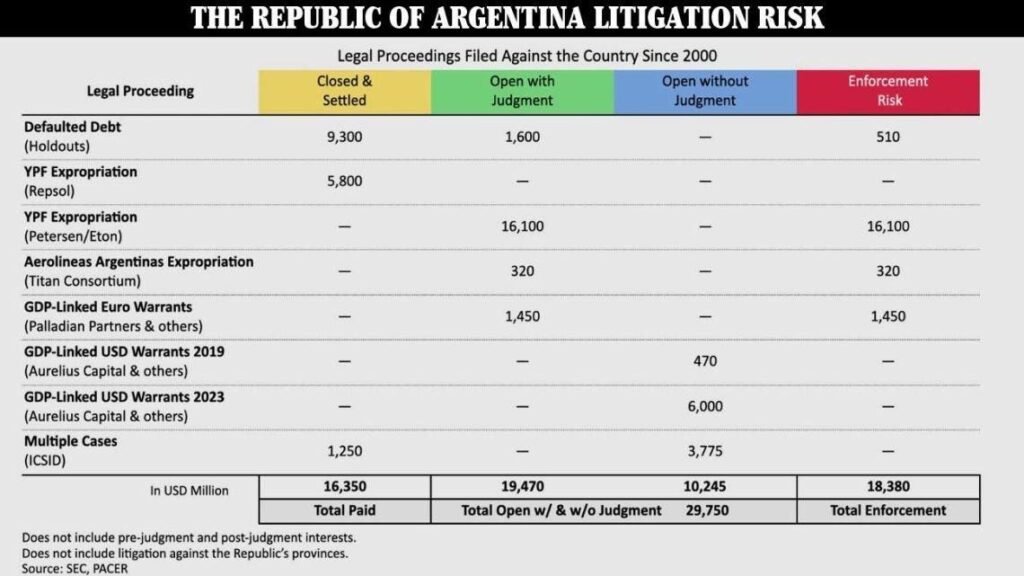

Ongoing legal battles, such as the YPF nationalization case, are adding to Argentina’s financial burdens. The government faces significant liabilities from legal proceedings, including potential asset seizures that could complicate matters further. Options for negotiation with litigation funds like Burford Capital could offer a solution that alleviates some of the financial strain on Argentina

The pressure is mounting on Milei and the government to address economic challenges and uncertainties. The need for pragmatic solutions and potential negotiations with external partners to alleviate financial burdens is becoming increasingly urgent. How Milei responds to these challenges will determine the success or failure of his economic plan and his ability to maintain support from the population and markets. The future of Argentina’s economic stability hangs in the balance as Milei faces increasing scrutiny and pressure in the wake of the exchange rate crisis.