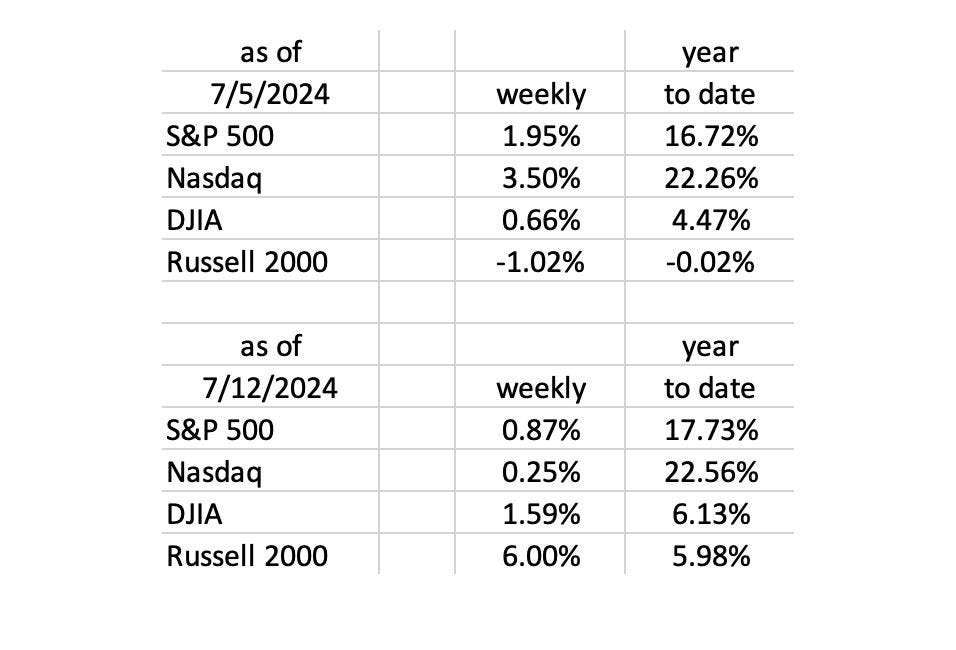

The equity market rally in the week ending July 12th saw small cap stocks, represented by the Russell 2000, outperforming tech stocks, the Nasdaq, the S&P 500, and the DJIA. The performance of small caps was particularly significant, with a 6% increase in year-to-date performance. Market commentary suggested that the small cap rally was a result of the momentum previously seen in the Mag 7 + Tesla stocks, prompting a shift in focus towards smaller players. Additionally, the rally in small caps may have been influenced by improved inflation readings, increasing the likelihood of a Fed rate cut in September.

However, despite the positive market performance, the labor market showed signs of weakness. The headline Nonfarm Payrolls report for June displayed a net gain of 206K jobs, but downward revisions to the April and May figures reduced the net gain to 95K. Negative revisions to NFPs have been common over the past 18 months, casting doubt on the credibility of the data. The Household Survey also indicated a modest increase in jobs, but full-time employment saw a decline, leading to concerns about a looming recession.

The highlight of the week was the inflation numbers, with the CPI showing a surprise deflation of -0.1% in June. This unexpected decline in prices solidified expectations for a Fed rate cut in September. While the Producer Price Index for June slightly exceeded expectations, certain subsets of the index, such as the Core Intermediate State PPI, suggested a trend towards disinflation and deflation. The data on goods prices and rents indicated a potential deflationary trend in the coming quarters.

The housing market continued to suffer under high mortgage rates, impacting existing home sales and new housing starts. Additionally, signs of a cooling economy were evident in various economic indicators, including Retail Sales and Employment data. Commercial Real Estate issues were also highlighted, with instances of office towers and apartment complexes facing foreclosure, suggesting looming problems for the banking system.

The Fed is expected to meet in July and September, with market odds of a September rate cut now exceeding 90%. While the Fed is seen as being behind the curve in addressing economic challenges, hopes for a rate cut in July remain uncertain. The forecast for two rate cuts this year is based on the belief that the economy requires additional stimulus to combat the looming recession. The potential impact of rate cuts on the economy is expected to be felt in the latter part of 2025, highlighting the lag effect of monetary policy changes.

Overall, the market performance, inflation numbers, labor market data, and housing market trends point towards a cooling economy and potential deflationary pressure. The need for effective monetary policy measures from the Fed to address these challenges and steer the economy towards stability and growth remains crucial. The focus on inflation, labor market dynamics, housing market conditions, and commercial real estate issues will continue to shape market sentiment and policy decisions moving forward.