Deere & Co. is currently ranked among the top 10% of dividend stocks in terms of strong fundamentals and inexpensive valuation by the DividendRank formula at Dividend Channel. This suggests that the company is one of the most interesting investment opportunities for investors to consider. Additionally, Deere’s stock entered oversold territory on Tuesday, trading at a low price of $348.19 per share. The Relative Strength Index (RSI) reading for Deere is 29.8, indicating that the stock may be oversold compared to the average RSI of 48.2 for dividend stocks.

The lower stock price of Deere presents an opportunity for dividend investors to capture a higher yield, as the company’s annualized dividend of 5.88/share yields 1.66% based on the recent share price of $355.00. This may be an attractive option for investors looking to increase their dividend income. The RSI reading of 29.8 could signal that the selling pressure on Deere’s stock is starting to taper off, potentially creating entry points for bullish investors to consider buying shares of the company.

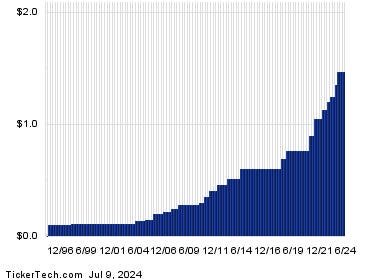

Investors interested in Deere should also consider the company’s dividend history when making investment decisions. While dividends are not always guaranteed, analyzing the historical dividend payouts can provide insight into the likelihood of future dividend payments. By examining the dividend chart, investors can assess whether Deere’s recent dividend payments are sustainable and likely to continue in the future. This information can help investors determine if Deere is a suitable investment for their dividend portfolio.

Overall, Deere & Co. presents an attractive opportunity for dividend investors due to its strong fundamentals, inexpensive valuation, and current oversold status. With a high dividend yield and potential entry points for investors, Deere may be a compelling option for those looking to enhance their dividend income. By conducting thorough research and analyzing the company’s dividend history, investors can make informed decisions about adding Deere to their investment portfolio.