The equity market closed the week on a negative note, with the Dow Jones Average, Nasdaq, and S&P500 all experiencing losses on Friday. The Russell 2000, which had been flat for the year two weeks ago, made gains this week, although it also saw a decline towards the end of the week. Market sentiment shifted towards smaller cap stocks and away from mega-cap tech stocks that have been in the spotlight.

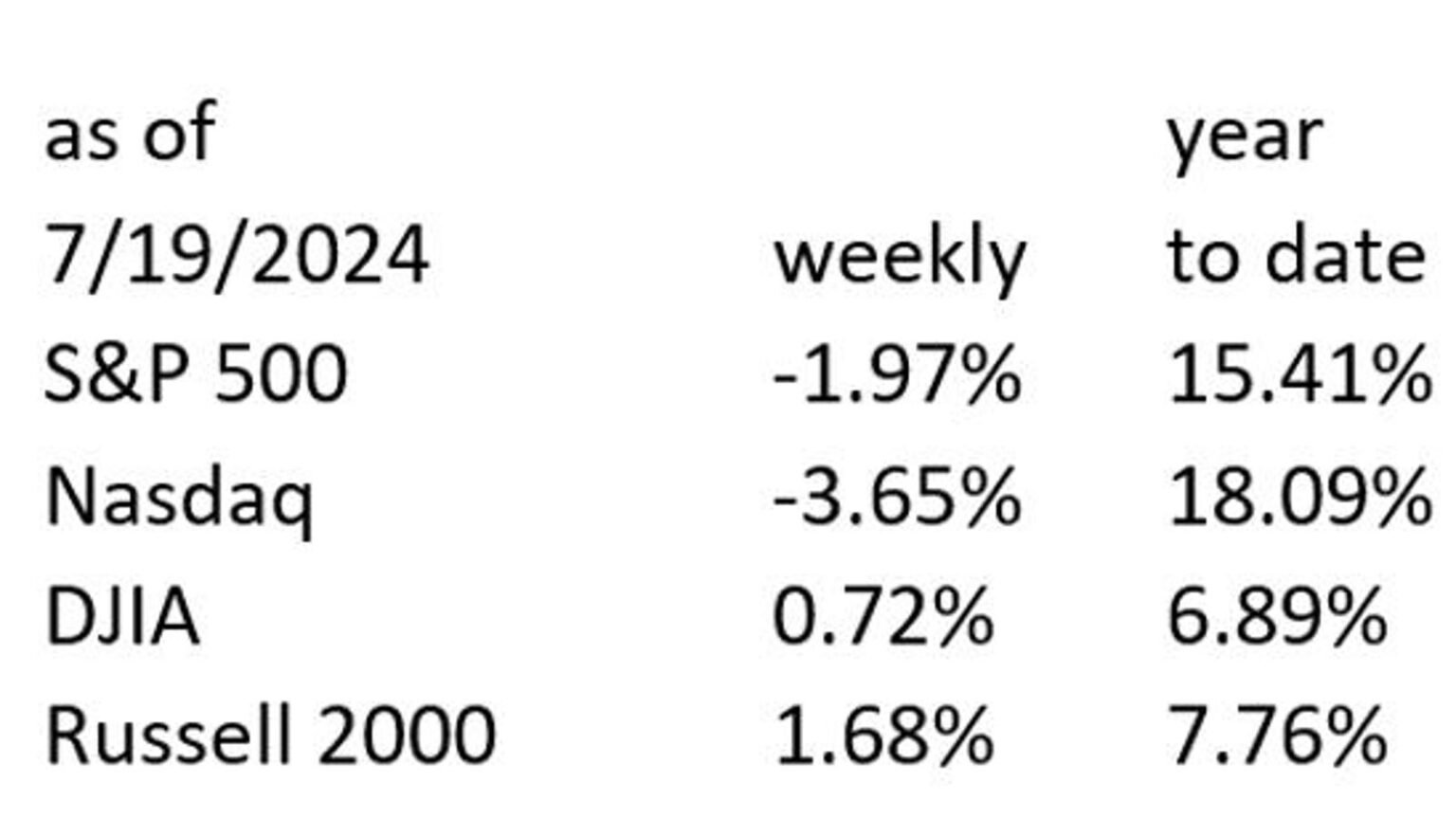

The previously hot Nasdaq and S&P500 cooled off this week, with losses of -3.65% and -1.97% respectively. The performance of the Magnificent 7, which includes the largest companies in the S&P500, has been on the decline since their peak prices in July. It is clear that a correction was due, and the question now is whether this downturn is over or if it will continue.

Incoming data has raised concerns regarding the equity markets’ assumptions of a “soft-landing” or no landing at all. The Conference Board’s Leading Economic Indicators for June were negative, which has historically been associated with recessions. The job market is also becoming a concern, with a rise in both Initial Jobless Claims and Continuing Claims. The Fed’s tight monetary policy is taking a toll on the economy.

Housing, which is a significant contributor to GDP, is also at a low point. Buying conditions for houses have declined, leading to a decrease in sales of large household goods. Inflation remains low, with the recent deflation in the CPI and falling prices of goods. Wage growth has moderated, and rent inflation is expected to dissipate with the possibility of rent deflation next year.

Looking ahead, there may be more giveback in the near-term for equities. The job market is expected to deteriorate further, with an increase in layoffs and a rising U3 Unemployment Rate. Interest rates have impacted the housing market, leading to a decline in home sales. The forecast is for an upcoming period of price deflation, with deflation and recession typically going hand-in-hand. However, inflation is expected to become a non-issue by the end of the year.