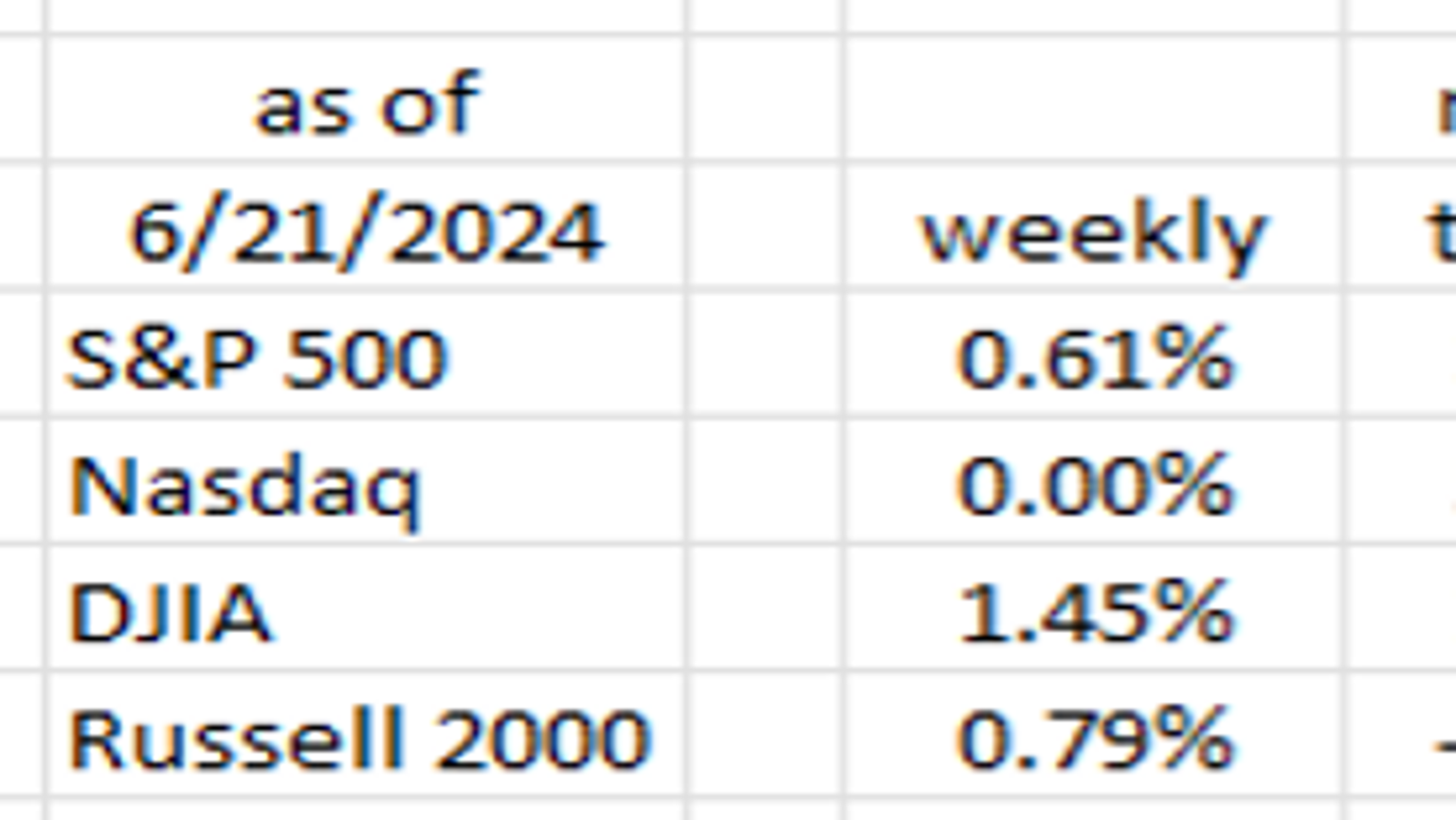

Equity markets experienced a subdued week, with both the S&P 500 and Nasdaq being held back by a downturn in Nvidia’s stock price. Despite this downturn, Nvidia’s stock was still up 155% year-to-date. The performance of major indexes such as the DJIA and Russell 2000 were weaker compared to the tech-heavy Nasdaq and S&P 500, which are capitalization weighted with a larger focus on tech companies. The lag in the industrial and small-cap indexes may be attributed to the current state of manufacturing and lack of hype surrounding these sectors.

The effects of recent rate hikes are starting to emerge, with data showing a decline in Retail Sales, weakness in housing markets, and challenges in banking and Commercial Real Estate (CRE). Retail sales have been consistently down over the past eight quarters, with an overall negative trend in real retail sales. The National Association of Homebuilders (NAHB) Index also showed a decline, indicating a potential slowdown in the housing market. Total housing starts and new building permits are also down from year-earlier levels, impacting GDP growth.

The labor market is showing signs of weakness, with various indicators pointing to a downturn. The U3 Unemployment Rate has risen from 3.4% to 4.0%, historically signaling a recession. Initial Unemployment Claims and Continuing Claims are also on the rise, indicating a challenging job market. Despite these trends, the Fed remains optimistic that the U3 rate will remain at 4.0% by year-end, a projection that may be unrealistic given the current economic conditions.

Other signs of stress in the economy include rising delinquencies in consumer loans, with mortgage loan delinquencies also on the rise. The FDIC’s list of problem banks is growing, with $517 billion in unrealized losses, and Japanese bank Norinchukin plans to sell $63 billion of government bonds. The Commercial Real Estate (CRE) market continues to struggle, with distress evident in the Seattle/Tacoma market.

Overall, the weakening consumer activity, coupled with challenges in the housing market and banking sector, suggests a potential economic slowdown. The Fed’s lack of action in response to these indicators raises questions about their approach to monetary policy. Despite acknowledging the lags in monetary policy effectiveness, the Fed has not yet taken steps to ease policy. The possibility of rate cuts being reserved for a significant break lower in equities suggests a potential hidden agenda within the Fed’s decision-making process, leading to uncertainty in the market.