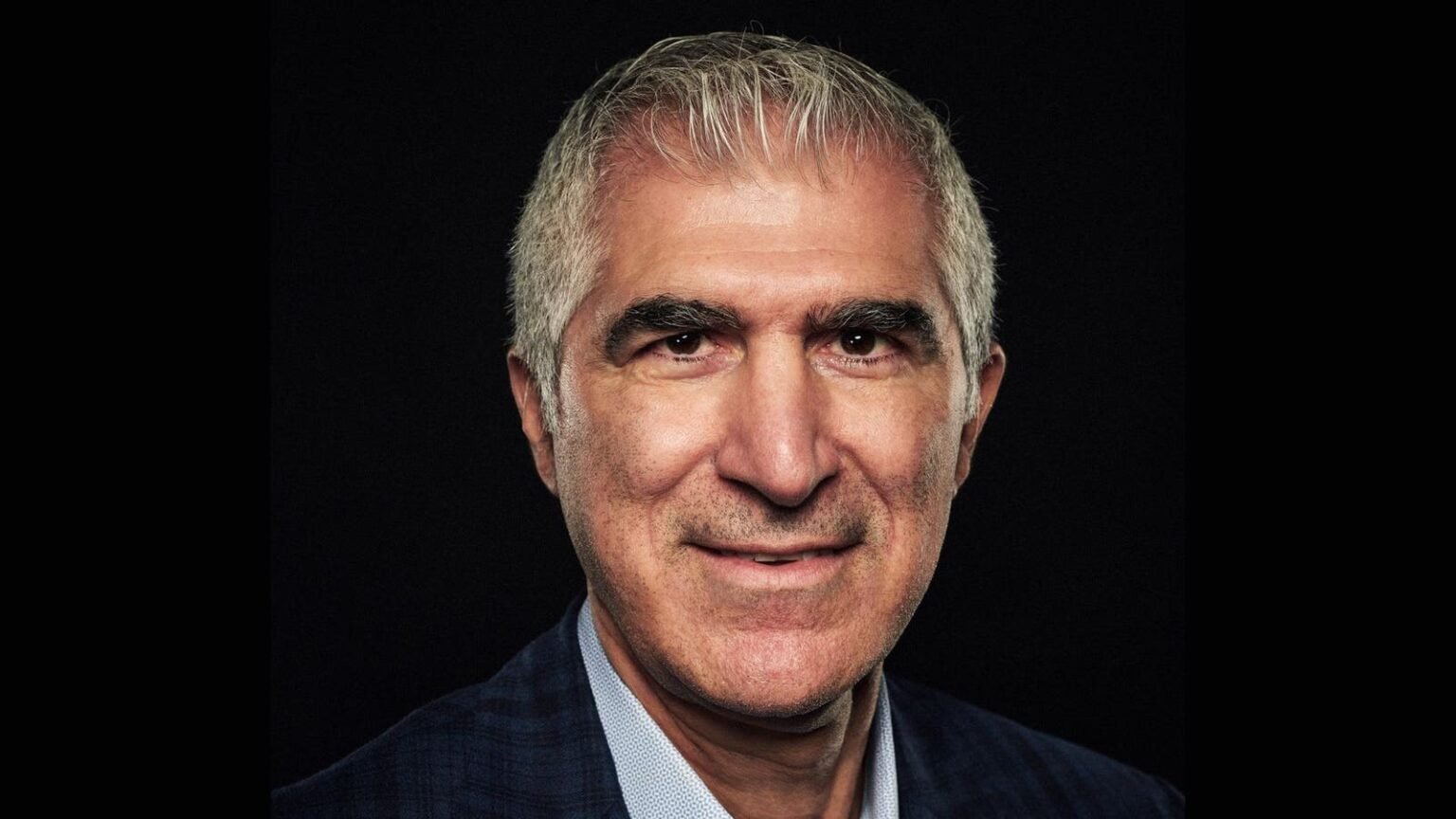

In a rare interview with Forbes, private equity tycoon Jahm Najafi shared insights into his investment career, revealing his key principles and strategies. Born in Iran, Najafi immigrated to the U.S. at a young age and pursued his education at UC Berkeley and Harvard before entering the world of finance on Wall Street. In 2002, he founded the Najafi Companies, focusing on buyout opportunities and managing his own capital. Notable investments include a successful bet on domain registrar Network Solutions and a stake in the Phoenix Suns, which has seen significant growth in value.

When discussing current risks for investors, Najafi highlighted geopolitical tensions as a major concern, particularly U.S.-China relations and conflicts in Ukraine and Israel. He emphasized the importance of maintaining liberal market principles and trade policies for global economic growth. However, he also noted opportunities in specific industries and geographic regions facing challenges, pointing to Ukraine as a fascinating location for potential investment given its resilience and potential for post-war reconstruction.

Najafi stressed the importance of partnering with the right management team when investing in industries outside his expertise. He shared insights from successful investments like Network Solutions, where he identified undervalued assets and transformed the business into a leading online services provider. He also reflected on a failed investment in the content development business, emphasizing the need for industry dislocation and execution in successful investments.

In terms of investment philosophy, Najafi credits his success to identifying economic and industry-specific dislocations, particularly during market crashes. By focusing on fundamentally sound businesses at lower valuations, he has been able to capitalize on recovery periods and achieve significant returns. When asked about advice for his younger self, Najafi emphasized the importance of learning from small mistakes, staying open to new experiences, and making critical decisions based on ongoing learning and experience.

For book recommendations, Najafi highlighted William Green’s “Richer, Wiser, Happier” for its emphasis on authenticity and leading a fulfilling life, as well as Peter Lynch’s “One Up On Wall Street” for its advice on decision-making. Overall, Najafi’s approach to investing combines a focus on fundamental analysis, strategic partnerships, and a willingness to pivot based on market conditions. His track record of successful investments and commitment to philanthropy through the Giving Pledge underscore his dedication to both financial success and social impact.