Intuitive Surgical recently reported its Q2 results, with revenues matching and earnings exceeding estimates. The company reported revenue of $2.0 billion and adjusted earnings of $1.78 per share, compared to estimates of $2.0 billion and $1.55, respectively. The company’s strong performance was driven by a 17% increase in global da Vinci procedure volume. ISRG stock has shown strong gains this year, up around 35%, outperforming the S&P 500 Index. However, the stock’s returns have been inconsistent in recent years, underperforming the S&P in 2022.

Consistently beating the S&P 500 has been challenging for individual stocks in recent years, including heavyweights in the Health Care sector and megacap stars. The Trefis High Quality Portfolio, a group of 30 stocks, has outperformed the S&P 500 each year over the same period. ISRG stock appears to be appropriately priced, with a valuation of $462 per share based on a 20x P/S multiple, aligned with the stock’s average P/S ratio over the last four years.

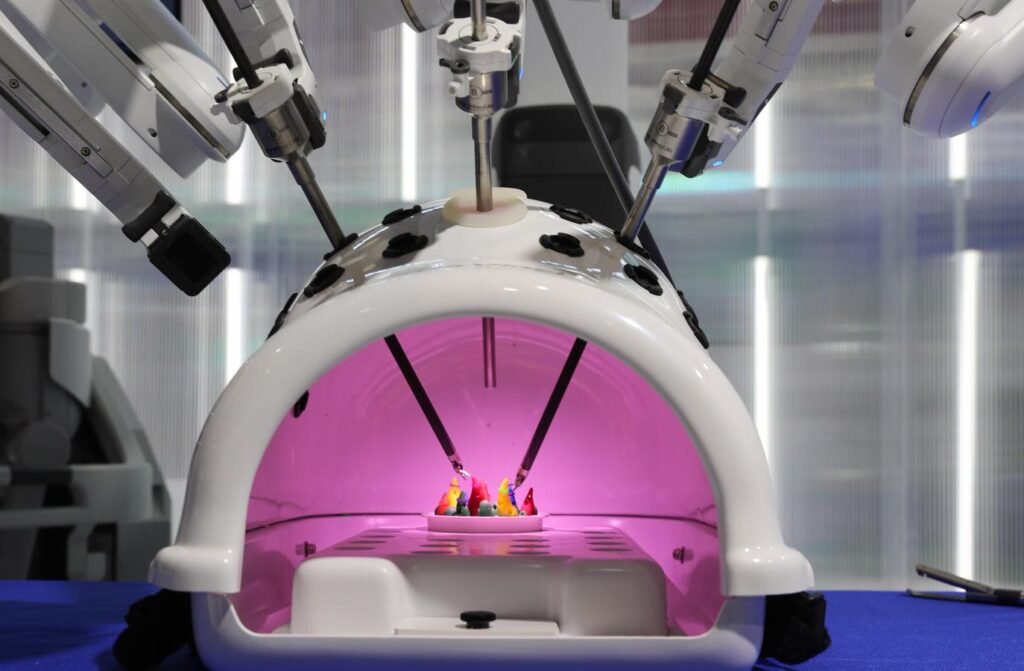

In the latest quarter, Intuitive Surgical’s revenue of $2.0 billion reflected a 6% year-over-year growth driven by a 17% increase in worldwide da Vinci procedure volume. The company placed 341 da Vinci systems during the quarter, expanding its total installed base to 9,203 systems. Operating margin expanded to 28.2% in Q2, while adjusted earnings stood at $1.78, a 25% increase over the prior year quarter. Intuitive Surgical narrowed its projected global da Vinci procedure volume growth to 15.5%-17% in 2024.

Intuitive Surgical has navigated well in Q2, with strong results and robust guidance. Despite a 9% rise in stock price post Q2 announcement, the stock appears to be appropriately priced. While ISRG stock seems appropriately priced, comparing how Intuitive Surgical’s peers fare on key metrics can provide valuable insight. Investors can find other valuable comparisons for companies across industries at Peer Comparisons. Overall, Intuitive Surgical’s performance in Q2 highlights its strong position in the market and potential for future growth.