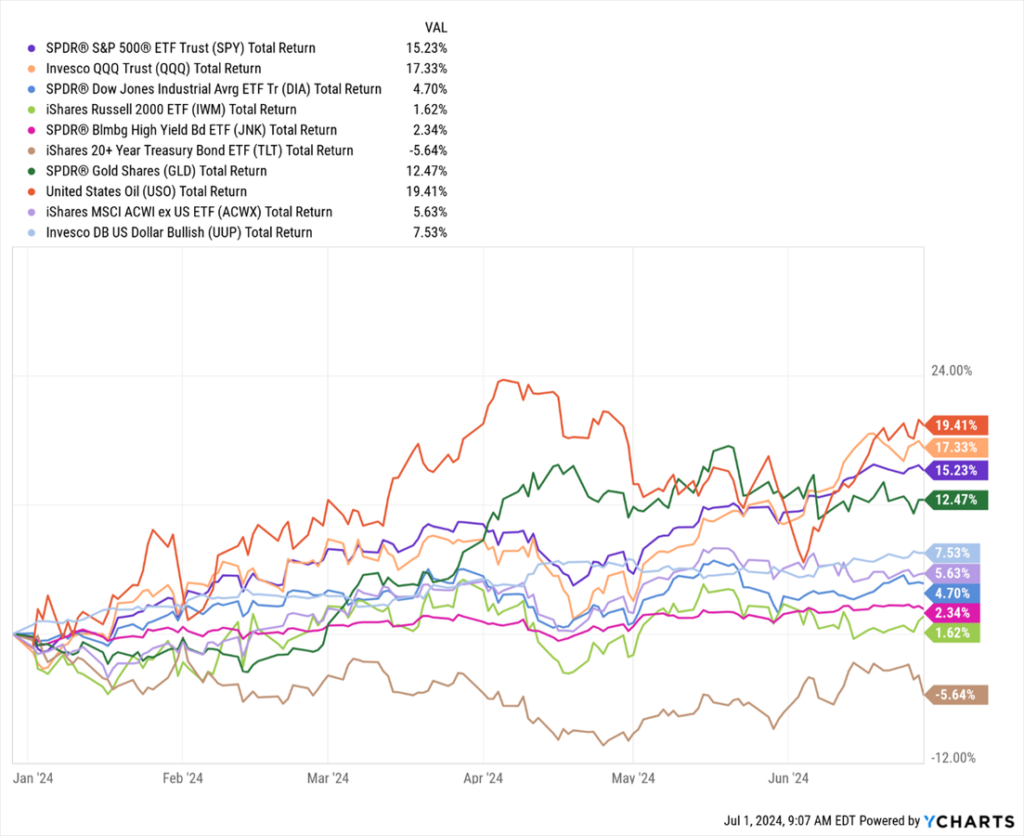

As the first half of 2024 comes to a close, investors are looking back at the performance of various assets so far and preparing for the second half of the year. The MoneyShow Chart of the Week provided a breakdown of how different assets have fared in the market. While technology stocks have been getting a lot of attention, the United States Oil Fund (USO) actually delivered the best performance with a total return of 19.4%, followed closely by the Invesco QQQ Trust (QQQ) with a return of 17.3%.

In the US market, the SPDR S&P 500 ETF Trust (SPY) gained 15.2% and the SPDR Gold Shares ETF (GLD) returned 12.4%. However, global markets, impacted by a strong dollar, didn’t fare as well as US markets, with the iShares MSCI ACWI ex US Index Fund (ACWX) only rising 5.6% in the first half of the year. “Old Economy” stocks and small caps also lagged behind, with the SPDR Dow Jones Industrial Average ETF (DIA) gaining just 4.7% and the iShares Russell 2000 ETF (IWM) rising a mere 1.6%.

When it comes to bonds, riskier bonds outperformed credit-risk-free government debt, with the SPDR Bloomberg High Yield Bond ETF (JNK) gaining 2.3% while the iShares 20+ Year Treasury Bond ETF (TLT) lost 5.6%. In terms of S&P 500 sectors, the Communication Services Select Sector SPDR Fund (XLC) came out on top with a return of 19.6%, followed by the Technology Select Sector SPDR Fund (XLK) at 17.9%. The Real Estate Select Sector SPDR Fund (XLRE) was the only sector fund to lose money, with a decline of 2.4%.

The overall message from the Chart of the Week is that the market remains in a bullish mode, with offensive sectors and assets outperforming defensive ones. While there is a lack of market breadth, it does not appear to be a rally killer at this time. The data continues to support a bullish outlook, in line with the story that has been unfolding since the beginning of 2023. Investors are advised to stay bold and continue to take a bullish approach to their investments until the tone and data suggest otherwise for the market moving forward.