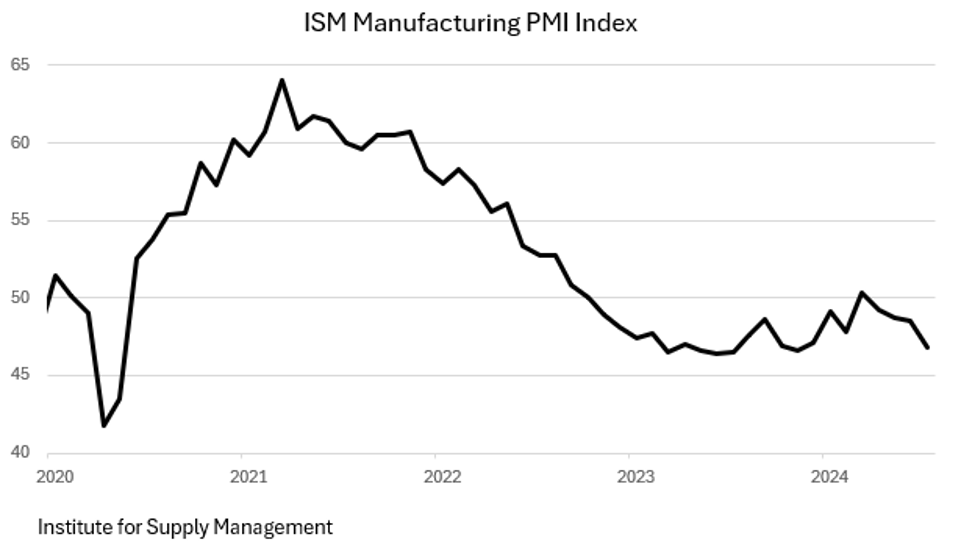

In a recent blog post, it was predicted that the Federal Reserve would make two rate cuts totaling 50 basis points by the end of the year. However, due to the weak jobs report released on Friday, it is now believed that the Fed may need to cut rates by as much as 100 basis points before the end of the year. The weakening economy is evident in various data points, such as the ISM Manufacturing Index remaining below 50 for 20 of the last 21 months and the disappointing Nonfarm Payroll numbers.

The Nonfarm Payroll number, which came in at +114K, was lower than expected, with downward revisions to the past two months. Additionally, the Household Survey showed a rise in the Unemployment Rate from 3.4% in April to 4.3%. The Sahm Rule, which predicts a recession when the U3 unemployment rate rises 50 basis points above its minimum value in the prior 12 months, has been triggered. There has also been a decrease in the workweek and an uptrend in Initial and Continuing Unemployment Claims, indicating an economic slowdown and a possible recession on the horizon.

The equity market reacted negatively to the economic data, with major indexes like the S&P 500, Nasdaq, DJIA, and Russell 2000 experiencing declines. The Magnificent 7, a group of high-performing stocks, also saw declines since their peaks earlier in July. The poor job report last Friday contributed to the market sell-off, as it highlighted the overall weakness in the economy and consumer sentiment.

The Federal Reserve’s latest policy statement emphasized its attention to both inflation and the labor market, signaling a shift in focus towards economic factors. Markets have now priced in three rate cuts by the end of the year, with a high probability of a 50 basis point cut in September. Despite these actions, it is believed that the Fed is behind the curve and should be approaching a more neutral policy rate sooner to avoid a recession.

Consumer loan delinquencies, slow wage growth, and weak retail outlooks from companies like McDonald’s, Wendy’s, Nestle, and Qualcomm further indicate a struggling economy. With inflation on the decline, it is expected that the CPI will reach or fall below the Fed’s 2% target rate by the end of the year. The market response to the weak jobs report and other disappointing economic data shows a growing concern for a looming recession.

Overall, the economy is showing signs of weakness and a potential recession, with markets anticipating further rate cuts by the Fed. The focus is now on economic indicators and the Fed’s response to mitigate the impact of a slowing economy. Despite the challenges ahead, there is optimism that the inflationary pressures will subside, providing some relief to the economy in the coming months.