Nvidia’s stock has experienced a significant increase, reaching about $1,200 a share, up 287% since the company’s successful earnings report in May 2023. However, with the stock set to undergo a 10-for-1 split on Monday, dropping the price to around $120 per share, the question arises whether the stock price will ever return to $1,200. Several factors could contribute to this potential rise by 2026, including government interest in generative AI, Nvidia’s strong performance and growth investments, as well as CEO Jensen Huang’s leadership.

One risk to consider is the conflicting attitudes of business leaders towards generative AI. While they fear being left behind in the AI boom, they are also concerned about the potential negative impact of AI hallucinations on their company’s reputation. This tension could hinder the implementation of high payoff generative AI applications, impacting the demand for Nvidia’s technology. Without significant advancements in this area, sustaining the demand for Nvidia’s GPUs may become challenging in the future.

Governments around the world are fueling the growth of Nvidia by purchasing GPUs to develop sovereign AI capabilities within their countries. This trend is driven by the desire for strategic self-reliance and a quest for independence amid increasing tensions between the U.S. and China. Nvidia anticipates that sovereign AI spending could contribute $10 billion in revenue in 2024, providing a new source of growth for the company and diversifying its revenue sources.

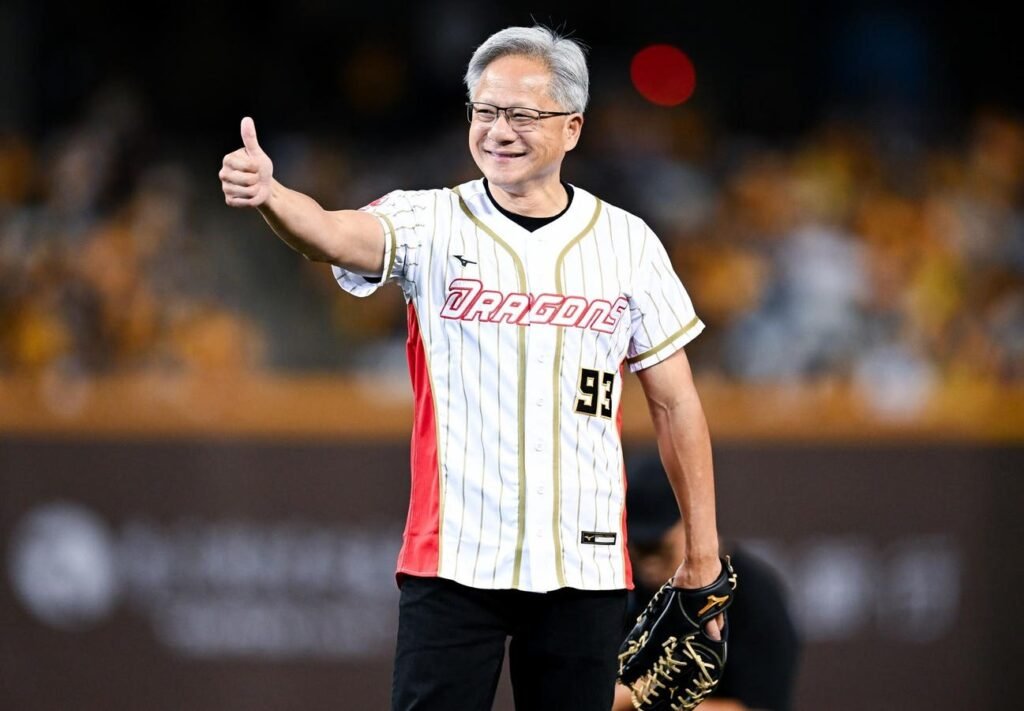

Additional growth drivers for Nvidia include expectations-beating financial performance, growth investments in new product introductions, and CEO Jensen Huang’s leadership talent. The company’s first-quarter results exceeded expectations, and its forecast for future revenue growth is promising. Huang’s ability to introduce innovative products and navigate changing market demands is seen as a key factor in sustaining Nvidia’s growth. As the demand for GPUs from cloud service providers matures, the influx of sovereign AI customers could help offset potential revenue slowdowns.

Business leaders’ apprehension about the risks associated with generative AI poses a challenge for companies looking to implement high payoff applications. The fear of AI hallucinations damaging a company’s reputation has led to cautious experimentation with AI initiatives, limiting the release of such applications. Unless companies can find successful generative AI applications, the demand for Nvidia’s GPUs may wane over time. However, the fear of falling behind in the generative AI race could help drive continued demand for Nvidia’s chips and contribute to the company’s stock growth.