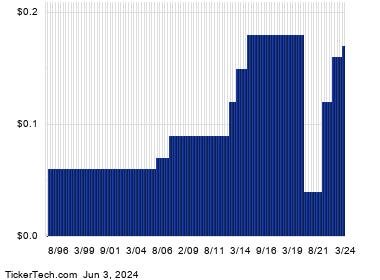

Halliburton is set to trade ex-dividend on 6/5/24, with a quarterly dividend of $0.17 payable on 6/26/24. This dividend amounts to approximately 0.46% of HAL’s recent stock price of $36.70. A dividend history chart for HAL shows the historical dividends prior to the most recent $0.17 declared by the company. Dividends are not always predictable, but the historical data can help in determining whether the current estimated yield of 1.85% on an annualized basis is reasonable.

The one-year performance of HAL shares compared to its 200-day moving average is shown in the chart. The stock’s 52-week range is from $30.04 per share to $43.85 per share, with the last trade at $36.24. In Monday trading, Halliburton shares are up approximately 2.1% for the day. Investors interested in income investing can join the conversation on the ValueForum.com platform with a special offer of Seven Days for Seven Dollars.

Overall, the dividend history and performance chart of HAL provide valuable insights for investors. While dividends may not always be predictable, analyzing the historical data can help in making informed decisions about the potential continuation of dividends and the expected yield going forward. The current estimated yield of 1.85% indicates a reasonable expectation of annual yield for HAL.

With the upcoming ex-dividend date and quarterly dividend payment, investors can consider the impact on their investment strategy. Halliburton’s dividend payout of $0.17 per share represents a percentage of the stock price, providing an additional income stream for shareholders. The stock’s performance in Monday trading reflects a positive trend, with shares up by 2.1% for the day.

In conclusion, Halliburton’s upcoming ex-dividend date and quarterly dividend payment offer an opportunity for investors to assess their investment strategy and potential income from dividends. The historical dividend data and stock performance chart provide valuable information for investors looking to make informed decisions about their investments. With a current estimated yield of 1.85%, HAL continues to be a stock of interest for income investors.