Former billionaire Ryan Breslow has shocked investors with his latest plan to raise $450 million for his payments startup Bolt at a valuation of $14 billion. The deal, outlined in an email sent to shareholders by interim CEO Justin Grooms, includes funding from U.A.E and U.K-based investment firms. However, one of the lead backers named in official documents, Silverbear Capital, claims they were never involved in the deal and had never spoken with Breslow or Bolt.

The deal has been characterized by complex and shifting terms that have left investors scrambling to understand how it will impact them. Investors have expressed outrage over the proposed terms, which they say would enrich Breslow and potentially wipe out 70% of their shares if they don’t invest in the round within a tight deadline. Several shareholders have even announced they are boycotting the round and considering legal action against Bolt.

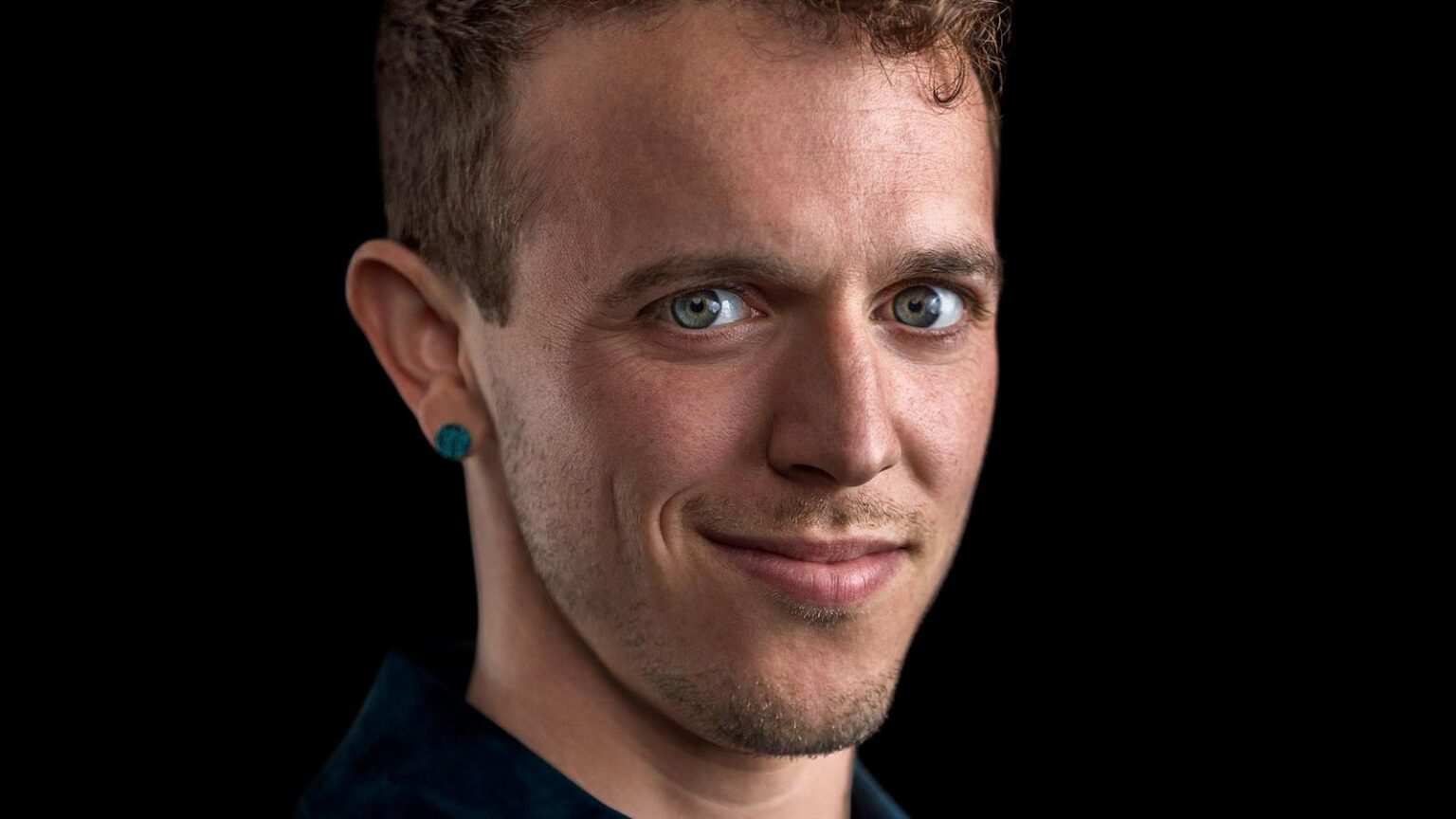

While Breslow has faced controversy in the past, including allegations of fraud, massive layoffs, and legal battles, his latest move to potentially reinstate himself as CEO of Bolt has raised eyebrows among investors. The deal also includes unusual components such as a pledge of $250 million in “marketing capital and dollar credits” from a creators’ platform called Influence, run by The London Fund’s CEO Ashesh Shah. These entanglements have raised concerns about conflicts of interest among investors.

Despite the controversies surrounding the deal, both Breslow and Shah defend the proposed terms as fair and necessary to attract Breslow back as CEO of Bolt. Shah, who has also faced litigation in the past, sees the deal as an opportunity to invest in Breslow’s broader “ecosystem” of companies, which includes a wellness marketplace, crypto payments platform, and lending platform. The deal also includes provisions for profit sharing and charitable donations, further complicating the situation for investors.

The unfolding saga at Bolt comes on the heels of Breslow’s previous controversies, including a Securities and Exchange Commission probe into potential misrepresentations to investors during a previous fundraise. Breslow was also sued by a former board member for defaulting on a $30 million loan secured against his stock. The settlement of this suit, along with objections from major investors, adds another layer of complexity to the deal and its potential impact on stakeholders.

As investors continue to grapple with the implications of the proposed deal, the future of Bolt remains uncertain. With conflicting reports and shifting terms, the situation highlights the challenges of navigating high-stakes investments in the tech industry. Meanwhile, Breslow’s reputation as a disruptive entrepreneur faces further scrutiny as he seeks to chart a new course for his payments startup in the midst of controversy and legal challenges.