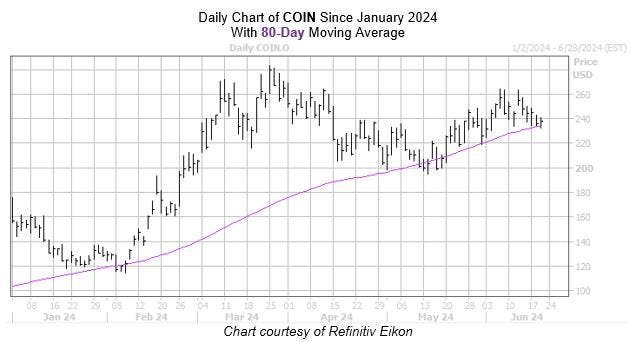

Coinbase Global (COIN) has had a tough quarter, with the stock down 10% since the beginning of Q3 and far from its two-year high of $283.48 in March. However, there may be hope on the horizon as the stock approaches a historically bullish trendline. According to data from Rocky White, COIN is within one standard deviation of its 80-day moving average, a signal that has historically led to gains. In the past three years, similar signals have resulted in the stock being higher one month later 67% of the time, with an average gain of 23%. With the stock currently at $238.78, a similar move would put it at around $293.70, levels not seen since December 2021.

Despite a strong year-over-year lead and a solid year-to-date gain of 36.4%, analysts remain bearish on COIN. Out of the 21 brokerages covering the stock, 11 recommend a “hold” and two rate it a “strong sell.” However, a reversal of this pessimism could help to push Coinbase stock higher. Additionally, the stock’s Schaeffer’s Volatility Scorecard (SVS) stands at 71 out of 100, indicating that the stock has exceeded option traders’ volatility expectations in the past year, which can be a positive sign for premium buyers.

Overall, there may be potential for Coinbase Global stock to rebound after its recent pullback. The stock’s proximity to a historically bullish trendline, along with past signals indicating potential gains, could point towards a positive outlook for investors. While analysts remain bearish on COIN, a change in sentiment could help to boost the stock further. The stock’s high volatility score also indicates potential opportunities for premium buyers, adding to the overall positive potential for COIN.

Investors will be keeping a close eye on Coinbase Global stock in the coming weeks to see if it can continue its recent upward momentum. With signals pointing towards potential gains and the stock’s history of exceeding volatility expectations, there is hope that COIN could see a rebound in the near future. As the stock continues to approach levels not seen since late 2021, investors may be looking to capitalize on the potential for growth in Coinbase Global.