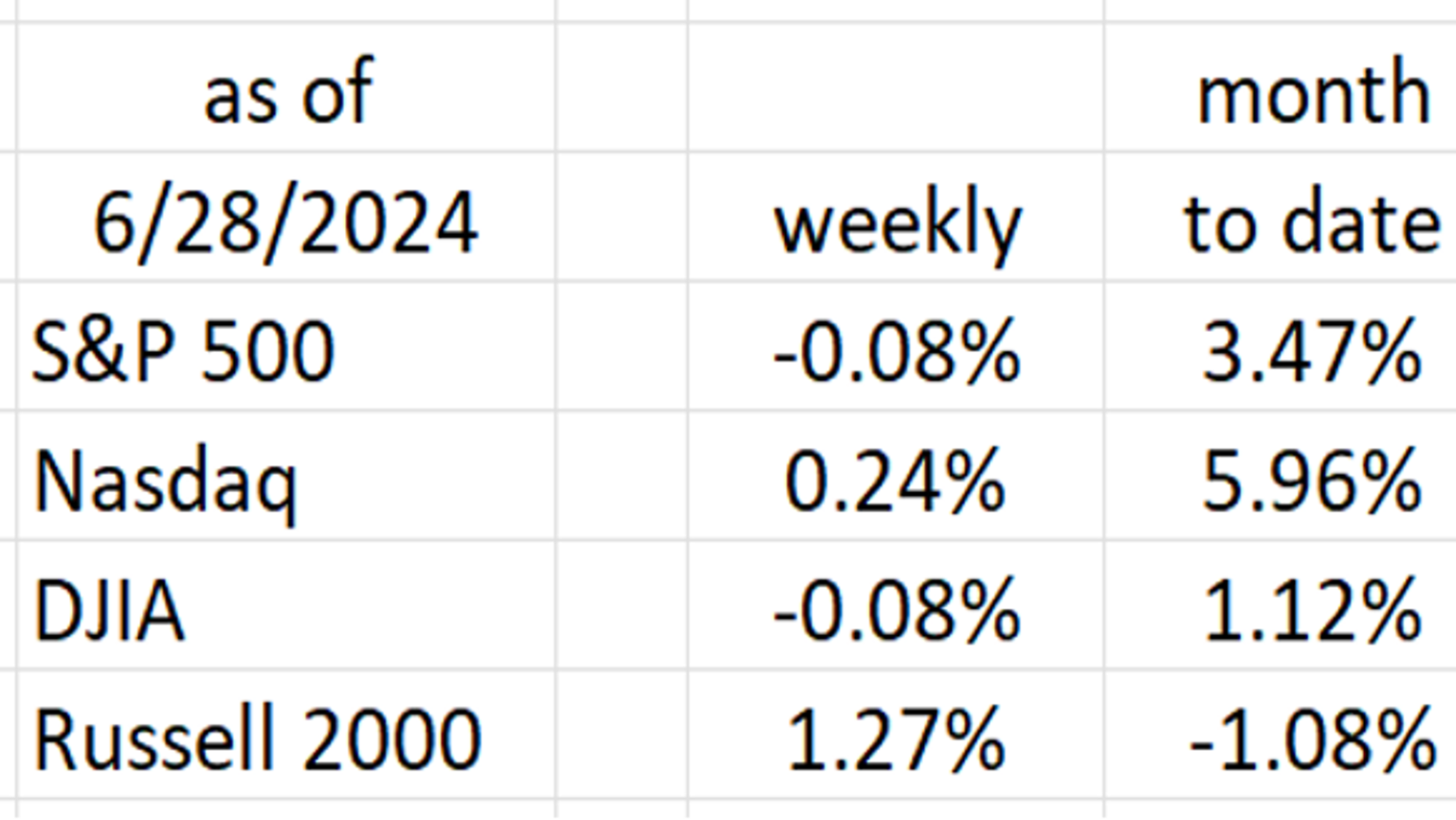

In a recent analysis of the equity markets, it was observed that small cap stocks and industrials have not participated much in the market run-up, while the Nasdaq and S&P 500 have performed better due to their large technology components. The stock run up is very narrowly based, with only 7 major tech companies driving the market gains. This narrow focus raises concerns about the overall health of the market.

The housing market, often considered a barometer of the economy, has shown signs of slowing down. Existing home sales have decreased, partly due to rising mortgage rates that have made it difficult for homeowners to move. Supply is constrained, and demand has decreased at higher mortgage rates. Despite this, home prices have continued to rise, although it is expected that prices will start falling as the economy weakens.

Inflation remains a concern, with the PCE Deflator showing a slight decrease in May. The Fed’s forecast for the end of the year for the PCE Core rate is 2.8%, but the current rate is slightly below that. This has led to increased market expectations for a rate cut in September. The CPI, excluding the shelter component, is already below the Fed’s 2% target, indicating that inflation may soon meet the desired goal.

Retail sales have been stagnant, with consumer spending showing signs of tightening. General Mills and airline companies have reported lower sales, suggesting that consumers are cutting back on non-essential purchases. The fast-food industry has also seen price wars, indicating a soft consumer market.

Employment numbers have been showing signs of weakness, with rising initial and continuing jobless claims. The Fed’s forecast for the U3 unemployment rate is 4.0%, but it is expected to rise to 4.5% by the end of the year. Manufacturing indexes for major economies have also been largely negative, indicating a global slowdown.

Commercial real estate values continue to decline, with several significant foreclosures reported in recent weeks. This trend, coupled with weak economic indicators, raises concerns about the health of the financial system and the potential for more “problem” banks to emerge in the near future.Overall, the economic outlook appears to be softening, with various sectors showing signs of weakness and vulnerability.