Several media reports linked Monday’s decline in DJT stock to Trump Media’s SEC Form S-1/A filing, but it was not due to the reaudit of Trump Media’s finances by a new auditor. The reaudit resulted in minimal changes to the financial statements, with no material impact on the balance sheet, income statement, or cash flow statement.

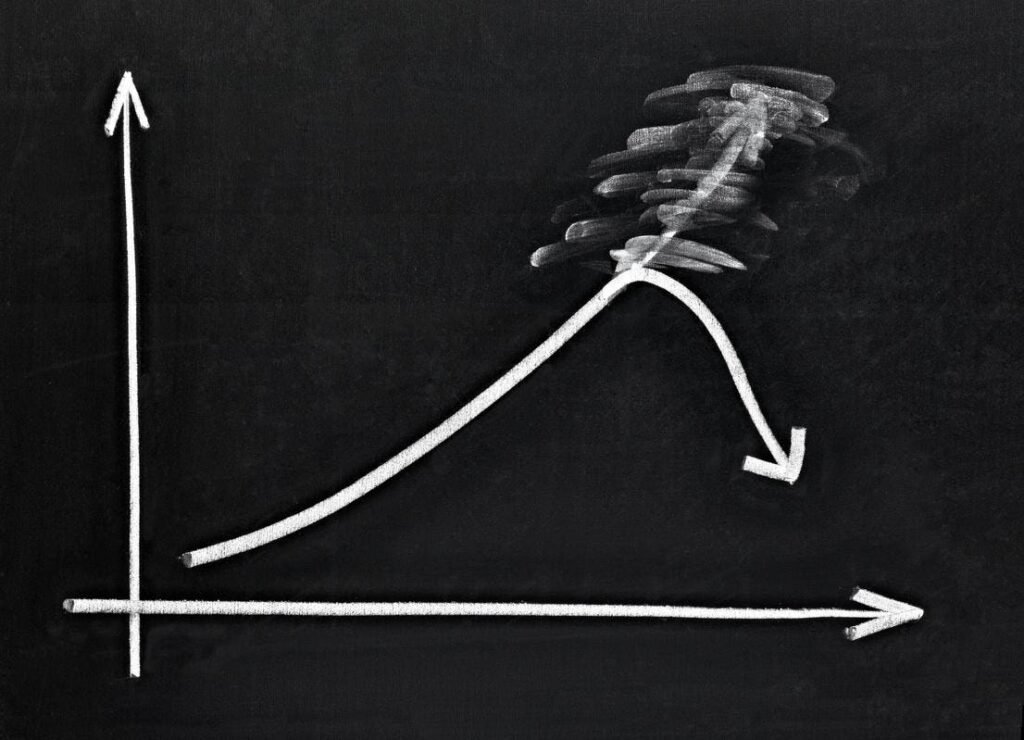

The real reason for the decline in DJT stock is the potential for shareholders to start selling once all 176 million shares are registered. Currently, 73.9% of outstanding shares are under a lock-up provision that delays selling until September 25. However, the lock-up period could end earlier under certain conditions, including a significant increase in the stock price over a 20-day period starting on August 22.

Given the uncertainties surrounding the potential selling of shares by shareholders, there is a possibility of a selloff in DJT stock. Some shareholders, especially those who received stock for services rendered or loans, may be eager to cash in their holdings. Short sellers, who currently hold about 10% of the tradeable shares, could also exacerbate any selloff that occurs.

The fundamental valuation of Trump Media remains a concern, as the company has not provided earnings call information for the first quarter and will need to demonstrate growth and profitability in the future. With uncertainties surrounding potential selling of shares, the presence of short sellers, and the lack of earnings information, DJT stock could face further declines in the near term.

As the registration of shares and the end of the lock-up period approach, the market will likely be closely watching for any signs of selling pressure or short interest in DJT stock. Ultimately, the future performance of Trump Media and its ability to generate earnings will play a key role in determining the stock’s direction in the coming months.