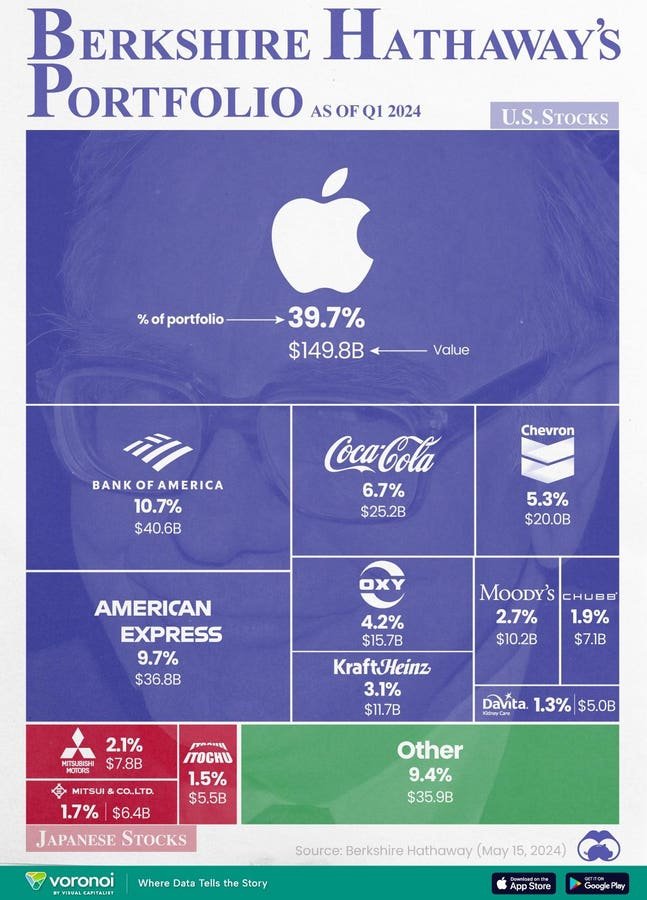

Warren Buffett has dumped over half of Berkshire Hathaway’s Apple stock holdings in the first six months of 2024, selling 55.8% of the shares. The sales amount to 505 million shares, with 115 million in the first quarter and 390 million in the second quarter. Reasons for this massive sell-off are unclear, but Apple’s slow growth rate and high valuation may have influenced Buffett’s decision to reduce his stake in the company. Other investors may take cues from Buffett’s actions and consider selling their Apple stock as well.

Since 2016, when Buffett first started buying Apple shares, Berkshire has invested around $40 billion in the tech giant. Despite the significant returns Apple has provided, Buffett has been steadily selling off portions of Berkshire’s stake. At the annual meeting in May, Buffett praised Apple’s business model but hinted at the possibility of selling due to potential increases in capital gains taxes. With a reduced stake now valued at $84.2 billion, questions arise as to whether other investors should follow Buffett’s lead and sell their Apple stock as well.

On the flip side, there are compelling reasons for investors to hold onto Apple stock. The company’s AI strategy, centered around a revamped Siri digital assistant, could drive more customers to upgrade their iPhones. Additionally, the integration of AI capabilities in the iPhone 16 series may lead to a stronger and longer upgrade cycle, boosting sales. Apple’s plan to add satellite connectivity to its iMessage app could also incentivize more people to purchase iPhones, further bolstering its sales numbers.

Despite the potential benefits of Apple’s AI strategy and upcoming features, the company faces several challenges that could impact its growth. Apple’s decelerating revenue growth, particularly in China, regulatory issues in the EU and the US, and the cancellation of its autonomous EV project all contribute to a less optimistic outlook for the tech giant. The lack of a significant growth driver, coupled with uncertainties surrounding future legal challenges, may deter investors from holding onto Apple stock.

Buffett’s decision to sell off a substantial portion of Berkshire’s Apple holdings may be influenced by the company’s current valuation. Apple’s stock now trades at around 30 times projected profits, compared to less than 15 times when Berkshire first started buying shares. The significant sell-off in the second quarter indicates that Buffett may continue to divest more Apple shares in the future. Whether consumers will find Apple’s AI offerings compelling enough to drive sales remains to be seen, and Buffett’s future actions may provide further insights into the company’s growth prospects.