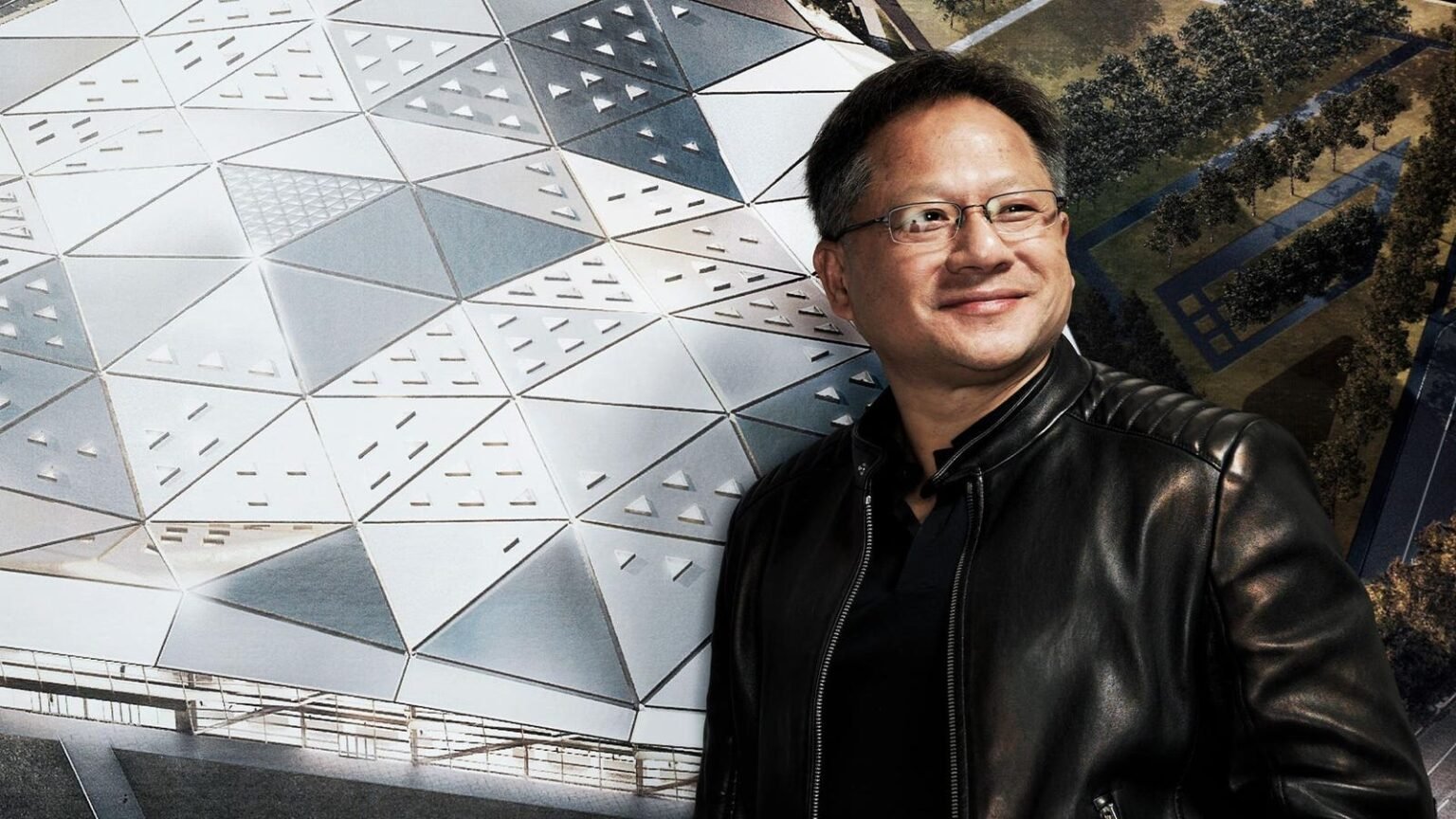

Nvidia, the third company to reach a $3 trillion market cap in the last two years, has seen unprecedented growth in the semiconductor industry. The company, based in Santa Clara, California, has climbed the Forbes Global 2000 ranking to No. 110 this year, up 131 spots from last year. Nvidia’s founder and CEO Jensen Huang attributes this success to the beginning of a new Industrial Revolution, with companies and countries partnering with Nvidia to shift traditional data centers to accelerated computing and build AI factories.

In its most recent fiscal year ending in January, Nvidia reported $61 billion in profits, more than double the previous year, and $30 billion in net profit. Its growth accelerated in the first quarter ending in April, with $26 billion in revenue—a 262% increase from the previous year—and $15 billion in net profit in a single quarter. Total assets grew to $77 billion, positioning the company for even higher rankings on the Global 2000 list. Analysts credit Nvidia’s dominance in designing GPUs, which have become essential for processing vast amounts of information quickly, especially in the realm of generative AI.

While Nvidia has been the primary player in the GPU niche, other companies have seen some success in this area as well. Advanced Micro Devices (AMD) has risen to No. 343 on the Global 2000 list and is expected to generate $4 billion in data center GPU revenue this year. AMD’s stock is up 25% in the last year, and 150% since the start of 2023, with a market cap of $260 billion. On the other hand, Intel, a longtime chipmaker founded in 1968, has rebounded to No. 107 on the Forbes list after restructuring its inventory and addressing other accounting issues. While Intel still leads Nvidia in total assets, its market cap remains stagnant at $135 billion.

Broadcom, another Silicon Valley veteran founded in 1991, has adapted well to the changing semiconductor landscape by securing lucrative deals with tech giants like Google and Meta for customized chips. The company’s $69 billion deal to acquire cloud computing firm VMWare closed last November, boosting its stock by 165% since the start of 2023 and pushing its market cap to a record high near $700 billion. Nvidia, Broadcom, and AMD are considered the top players in the GPU space, with Intel lagging behind due to its late entry into GPU production.

Overall, Nvidia’s rapid growth and success in the semiconductor industry have positioned it as a major player in the market. With its innovative technology and strategic partnerships, the company has set itself apart from competitors and solidified its position as a key player in the new era of accelerated computing and artificial intelligence. As Nvidia continues to expand its reach and drive further innovation, it is likely to maintain its strong position in the semiconductor industry for years to come.