Stocks rallied towards the end of last week after a rough start, with the S&P 500 gaining nearly 1% and the Nasdaq Composite closing flat. For the month, the S&P ended higher by 4.8% and the Nasdaq shot up almost 7%. Friday’s Personal Consumption Expenditures (PCE) Index report was in line with forecasts, easing fears of a surprise jump in inflation. However, other reports showed weakness in the economy, including a lower-than-expected Chicago PMI and reduced GDP forecast by the Atlanta Fed. Bond yields fell, and hopes for at least one interest rate cut this year remain strong.

Earnings season is winding down, with first-quarter earnings expected to grow by just under 6%, the strongest quarter in two years. The 12-month forward-looking P/E ratio is above its 5 and 10-year averages, and earnings for the next quarter are forecast to be 9.2% higher. The economic calendar for the upcoming week is heavy, with reports on the job market and May employment data expected. Economists are projecting 185 thousand new jobs and an unemployment rate of 3.9%.

Market sensitivity to economic reports is expected to increase, as hopes for multiple interest rate cuts diminish. The S&P 500 has an expected move of over 57 points, with market technicals showing some support and resistance levels. On Friday, the S&P 500 traded just above its 50-day moving average, and there were more new highs than lows made, indicating market strength. Market volatility is falling, with the VIX closing back under 13 on Friday.

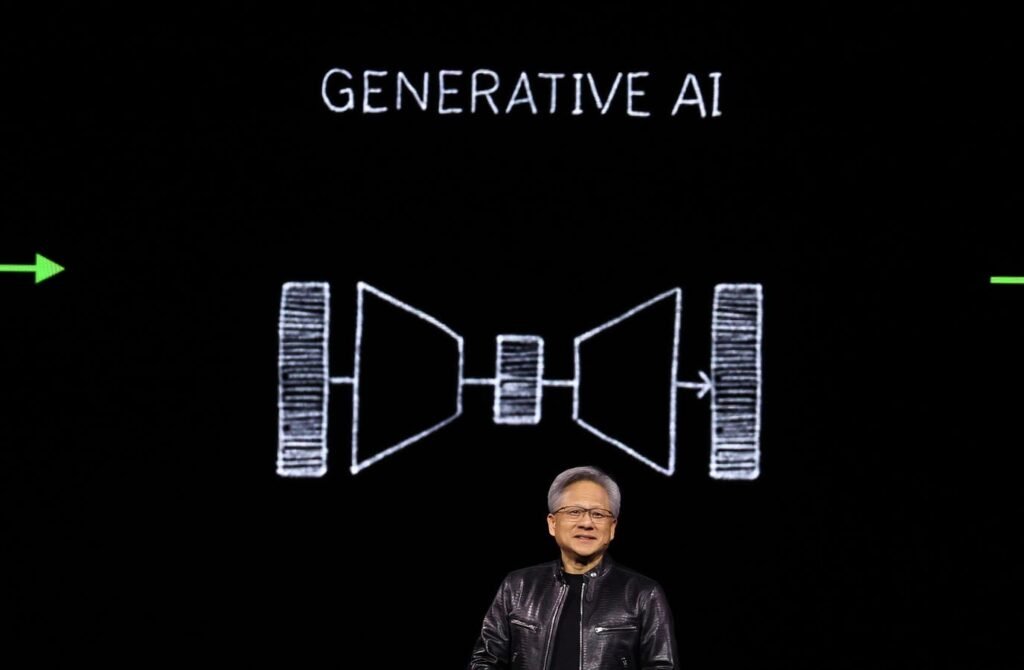

Looking ahead, investors are watching for sustainable momentum in the markets and keeping an eye on Nvidia’s upcoming 10-for-1 stock split scheduled for this week. It is important for investors to stick to their investing plan and long-term objectives. This content is for educational purposes only and not intended as trading or investment advice.