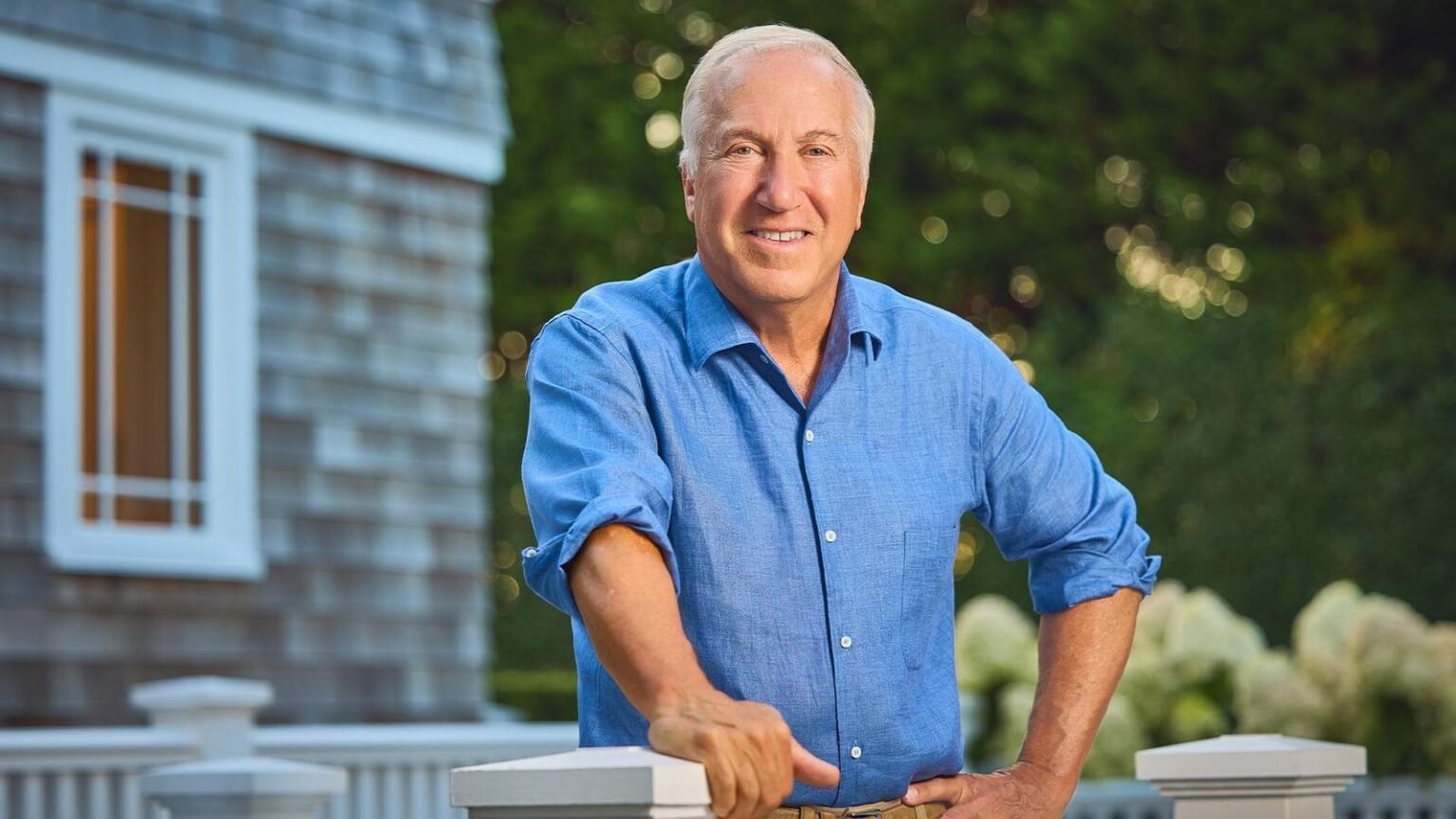

Real estate mogul Mitchell Morgan has made a name for himself as the founder of Morgan Properties, the third-largest owner of apartments in the U.S. with over 95,000 units across 19 states. His success has earned him a spot on the Forbes 400 list, ranking at No. 240 with a net worth of $5.5 billion. Morgan’s strategy involves investing in older apartment buildings in midsize cities and quickly renovating them to increase rents, focusing on Class B properties that target tenants with lower incomes.

By targeting less-fashionable markets like Reading, Pennsylvania and Rochester, New York, Morgan has found success where others may overlook. His approach of providing workforce housing with rents ranging from $1,500 to $1,800 a month has proven to be profitable, offering stable cash flow and resilience during economic downturns. Despite facing lawsuits in the past, Morgan Properties has settled disputes and maintains a strong reputation through its customer service team and commitment to renovations.

With a frugal approach learned from his humble beginnings, Morgan has navigated the real estate industry by partnering with investors and taking on minimal debt. After buying out his partners following the financial crisis, Morgan became the sole owner of 22,000 units by investing his own cash and taking on debt. His decision to keep the firm private, instead of going public, has allowed Morgan Properties to continue its successful strategy of buying, renovating, and increasing stake in properties once renovations pay off.

Backed by his sons Jonathan and Jason, who serve as co-presidents of the firm and lead various divisions within the company, Morgan has expanded the business into debt investments and joint ventures. With nearly $2 billion invested in debt portfolios issued by Freddie Mac and a focus on renovations across the portfolio, Morgan Properties continues to grow and evolve. Despite the oversupply of luxury apartments in some markets driving down rents, Class B properties remain a steady investment option for those seeking stable returns.

Looking ahead, Morgan remains optimistic about the opportunities in the real estate market and continues to expand the firm’s portfolio, acquiring $2.5 billion worth of apartments in 2021 and another $600 million in 2022. With a focus on value-add renovations and a commitment to providing quality housing at an affordable price, Morgan Properties plans to further solidify its position as a major player in the multifamily housing sector. As he reflects on his journey from selling shoes to becoming a billionaire real estate mogul, Mitchell Morgan remains focused on the potential for growth in the industry and the value of hard work and perseverance.